| Bootstrapping Spot Rates | 您所在的位置:网站首页 › spot rate计算 › Bootstrapping Spot Rates |

Bootstrapping Spot Rates

|

Bootstrapping Discount factors

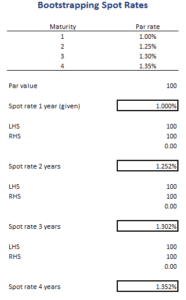

Bootstrapping spot rates or zero coupon interest rates works as follows. Suppose we are given two par rates, the par rate for one year (1.00%) and the par rate for two years (1.25%). First, note that we generally know the spot rate for a one year zero-coupon bond because that is simple the one-year par rate. To get the spot rate for a two-year zero coupon bond, we use the following formula Note that we set the left-hand side equal to 100. That’s because we are using the par curve. Solving the above formula, we obtain an interest rate of 1.252%. We can continue this process to calculate the 3-year zero coupon rate. This is something we illustrate in the numerical example below. Bootstrapping yield curve exampleLet’s turn to an example bootstrapping the yield curve in Excel. In particular, let’s bootstrap the rates for up to four years in the future. The following table shows the necessary steps. The spreadsheet can be downloaded below. Note that we used the Solver function of Excel to solve for the spot rate. Alternatively, it is possible to algebraically solve for the unknown spot rate. While both approaches will yield identical results, it is generally faster to use the solver.

|

【本文地址】